34+ getting mortgage as self employed

Ad Verify Income Using Bank Statements Not W2s or Tax Returns. Because you do not have.

Self Employed Mortgages Guide Moneysupermarket

Secure a home mortgage using 12 to 24 months of bank statements.

. Request a Quote Online in Minutes. Take Advantage And Lock In A Great Rate. Ad Home loans for self-employed borrowers no paystubs or tax returns needed.

USDA and VA loans wont require a down payment but conventional and FHA loans do. HMRC tax year overviews from the past two tax years. Improve your credit score and correct any errors on your.

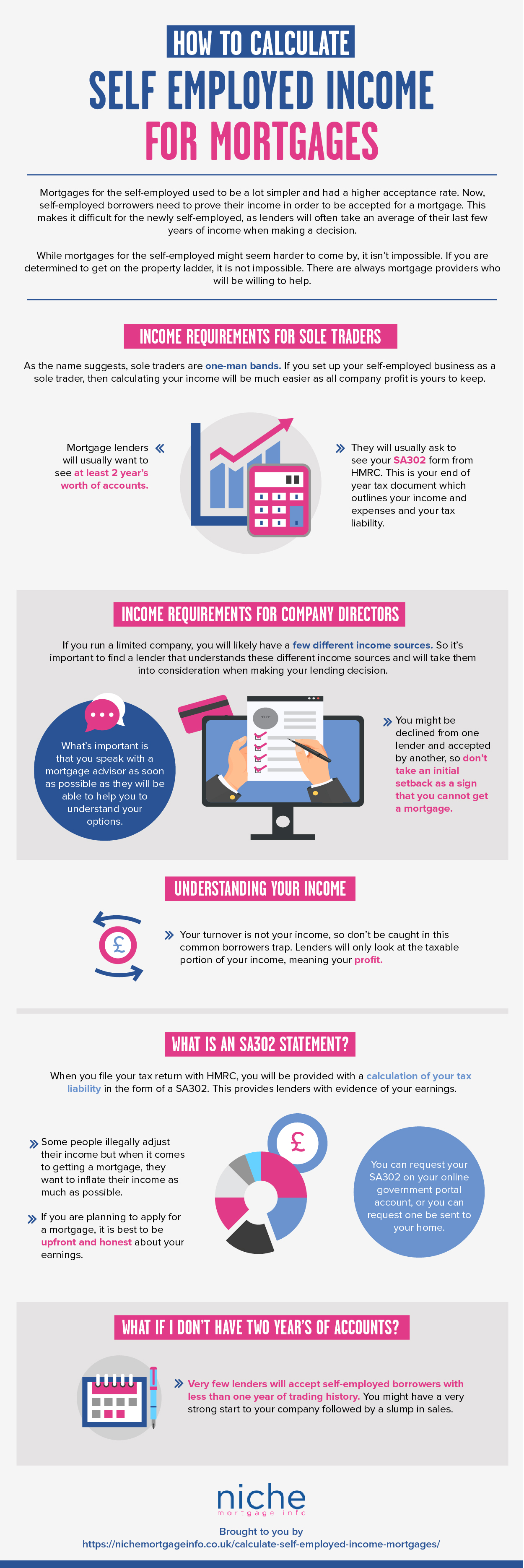

Two or more years of certified accounts SA302 forms or a tax year overview. If you are self-employed and hoping to get a mortgage. Apply Start Your New Home Loan Today.

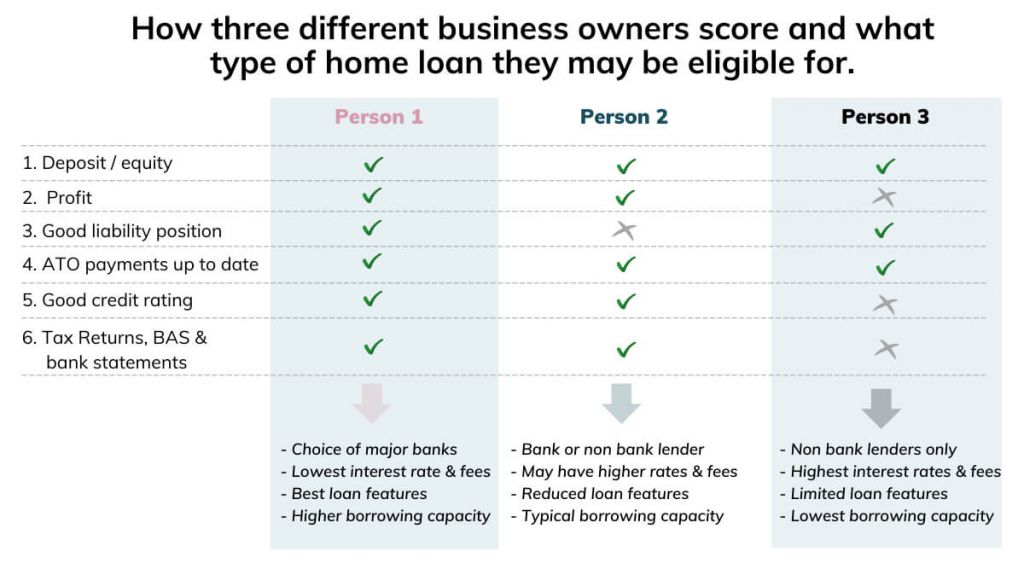

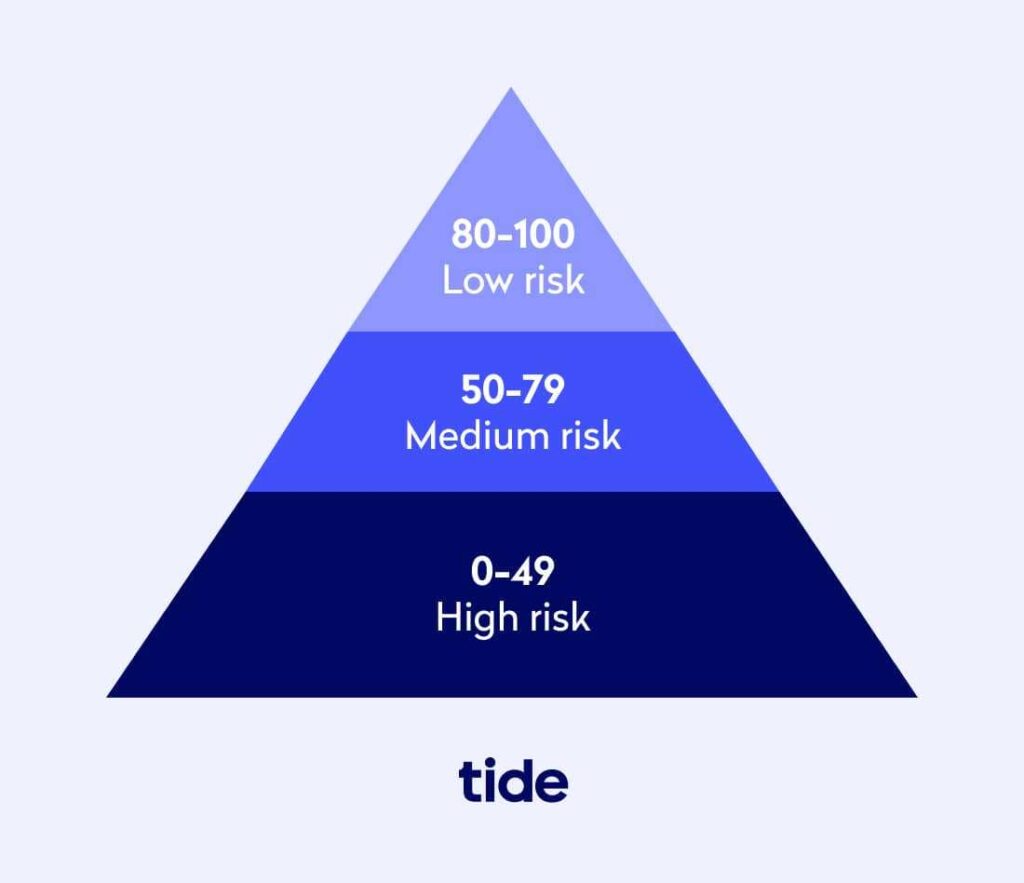

Web If you own more than 20 to 25 of a business from which you earn your main income generally lenders will view you as being self-employed. Web To qualify for the lowest mortgage interest rate possible as self-employed borrower follow these tips. Request a Quote Online in Minutes.

Web Heres a brief look at the four loan options you might use as a self-employed borrower. Ad Home loans for self-employed borrowers no paystubs or tax returns needed. Keep tax deductions to a minimum.

Conventional loans Most mortgage borrowers get conventional conforming loans. Web Essential requirements for getting a mortgage if youre self-employed. Web We had no issues getting a substantial mortgage as a bank considered self employed person but had nearly a decade of trading results.

Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Skip The Bank Save. Web Down payment size.

Secure a home mortgage using 12 to 24 months of bank statements. The good news is. Web Most buyers interested in getting a mortgage when self-employed do best with the same kinds of loans as other borrowers.

These mortgages typically require a credit score in the low. Additional reasons why self-employment may make it. Web A mortgage lender will consider you self-employed if you own more than 20 to 25 of a business from which you earn your main income.

Web The best way to increase your chances of being approved for a mortgage is to be prepared especially if youre self employed. Use Our Comparison Site Find Out Which Lender Suites You The Best. Dubbed the 3-2-1 Home Plus program it requires first-time buyers.

Web Just like any other home buyer self-employed buyers have four main options for a home loan. Web This can make it more difficult to prove steady income which can impact your chances of being approved for a mortgage. Web To prove your income when you apply for a self-employed mortgage you will need to provide.

Use NerdWallet Reviews To Research Lenders. Other proof of earnings over at. Web If youre self-employed you may be wondering whether you can easily get approved for a mortgageUnfortunately applying for a mortgage as a self-employed.

Youll need to provide the following documents if youre applying for a mortgage while self-employed. Some of the steps you should take. Its possible to buy with as little as 3 down or 35.

Web With that in mind here are a few tips to help you get approved for a mortgageeven if youre your own boss. Two years of personal. Web Advice on getting a mortgage self employed - Page 2 MoneySavingExpert Forum.

Apply Easily And Get Pre Approved In a Minute. As directorowner of a. Web In most cases self-employed mortgage loan borrowers need to provide the following documents to prove their income to a mortgage lender.

Ad 2022s Best Home Loans Rates Comparison. Special Offers Just a Click Away. Web Documents you will need.

Ad Award-Winning Client Service. Web Getting a mortgage is best not left to spur of the moment especially if youre self-employed so its a good idea to get pre-qualified for your loan. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web Yes you can get a mortgage if youre self-employed. Tax calculations and tax year overview SA302. Ad Compare Top Mortgage Lenders 2023.

Ad Verify Income Using Bank Statements Not W2s or Tax Returns. This could mean conventional. You might be a.

Web Guild Mortgage also claims a runner-up spot thanks to a unique first-time home buyer offering. Choose Smart Apply Easily. Web Often people that are self employedbusiness owners are discouraged by the mortgage process especially when dealing with large online lenders.

In general youll need to prove two years of income history from your self-employment with tax returns. Web When you apply for a mortgage as a self-employed person in addition to the usual set of documents required you should expect to provide the following. This info does not constitute financial advice always do your own research on top to ensure.

Web Getting a mortgage when you are self-employed can be more of a challenge but its still possible.

How To Get A Mortgage When You Re Self Employed Tide Business

Self Employed Mortgages With 2 Years Accounts

Self Employed Mortgage Loan Requirements 2023

How To Get A Mortgage When You Re Self Employed Tide Business

Self Employed Home Loans 2023 How To Get Prepared How To Get A Home Loan

How To Get A Mortgage When You Re Self Employed Tide Business

I M Self Employed Can I Still Get A Mortgage

How To Get A Mortgage When You Re Self Employed Superscript

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

How To Get A Mortgage When You Re Self Employed Tide Business

Mortgage Lenders Income Requirements For The Self Employed Niche

Questions A Lender Will Ask

How To Get A Mortgage When You Re Self Employed Money Empire New Zealand

What Income Do Companies Look At Self Employed The Mortgage Mum

Mortgage Lenders Income Requirements For The Self Employed Niche

Self Employed How To Tap Into The Best Mortgage Deals The Money Pages

Questions A Lender Will Ask